Historic Supreme Court decision on collecting sales tax from e-commerce.

What we're watching —

What this could mean for us "cliff notes"

1. States can require

e-tailers like us with no physical presence to collect and remit sales tax on sales delivered to

locations within their state.

2. This decision has HUGE implications for us as well as all internet retailers.

3. Online retailers, including ATTI, will need to collect & remit taxes to potentially hundreds of jurisdictions (states, cities, counties all which have different tax rates).

4. From small companies to large, the implications are huge.

5. We believe this will open the door to giants like Amazon forcing third-party sellers to collect and remit sales tax in states that force their hands.

6. Obviously, this will create significant chaos and administration.

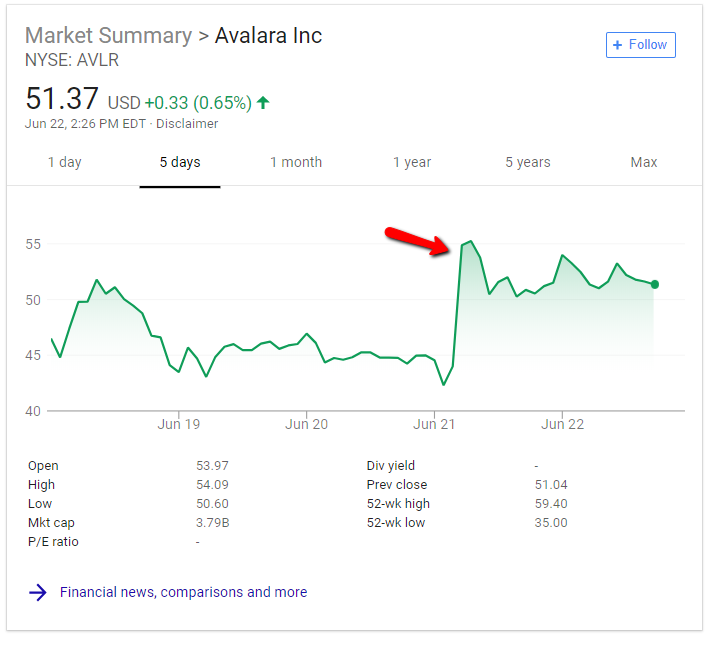

7. Tax preparation company Avalara soared as much as 33 percent Thursday, June 15th 2018 after a historic Supreme Court decision on collecting sales tax from e-commerce. View June 21, 2018 Avalara news here

8. This will directly impact Advanced Tachyon Technologies as we do not have adequate infrastructure to handle the increased administration.

We will keep an eye on this as it unfolds.